Business Insurance in and around Omaha

One of the top small business insurance companies in Omaha, and beyond.

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Tom Rivera can relate to the work that it takes and would love to help lift some of the burden. This is protection you'll definitely want to investigate.

One of the top small business insurance companies in Omaha, and beyond.

Helping insure businesses can be the neighborly thing to do

Strictly Business With State Farm

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a piano tuner or a hair stylist or you own a deli or a shoe repair shop. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Tom Rivera. Tom Rivera is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Visit State Farm agent Tom Rivera's team today to get started.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

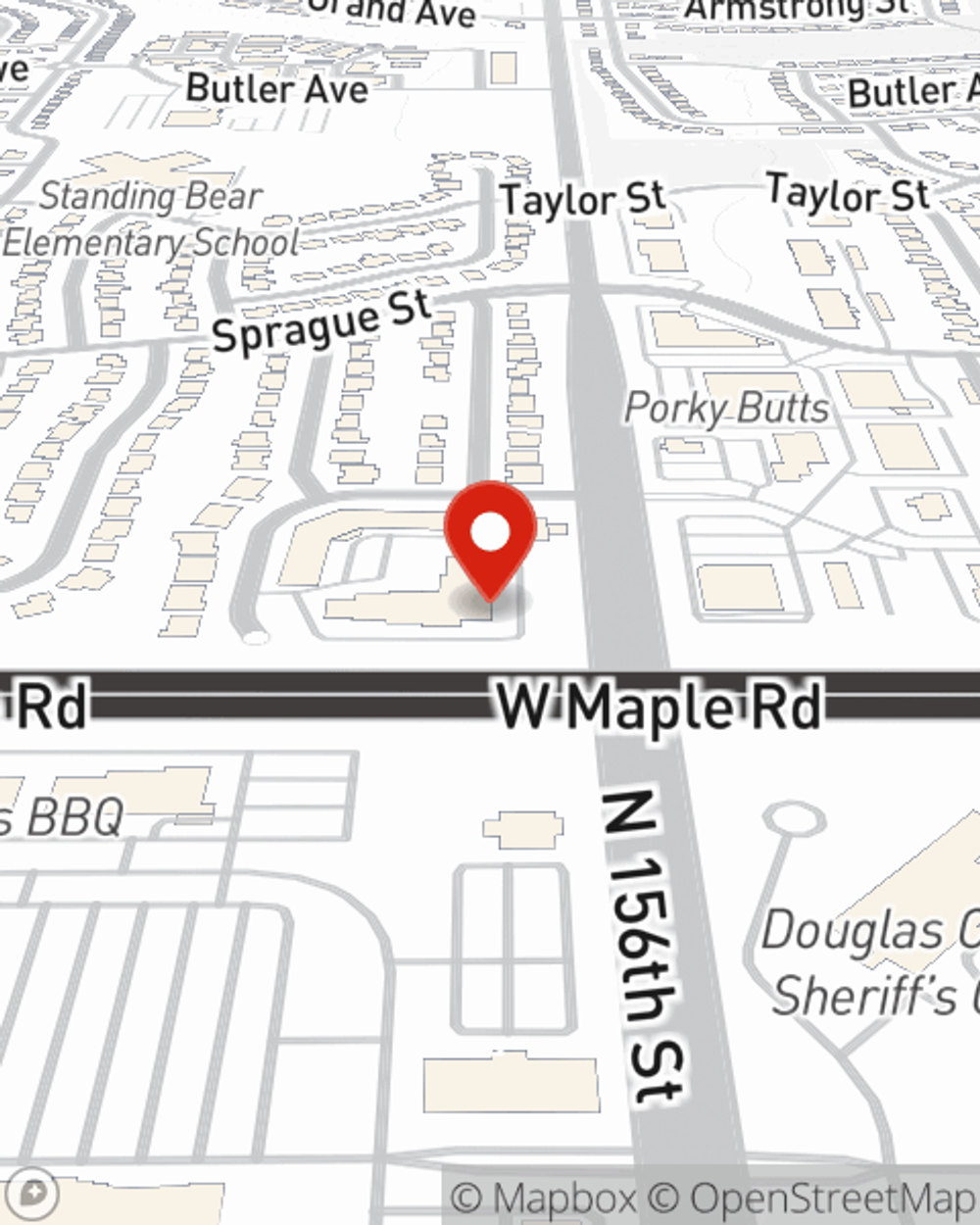

Tom Rivera

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.